India and the European Union (EU) have reached a historic free trade agreement (FTA) that will further open Indian markets to European goods, following nearly two decades of negotiations. One of India’s largest trading partners is the 27-member EU, which contributes 25% of the world’s GDP and 33% of global trade. It is expected that the India-EU trade deal aka “mother of all deals” will increase cooperation between the two world’s largest economies in important policy domains like trade, security, and defense.

“We have concluded the mother of all deals. We have created a free trade zone of two billion people, with both sides set to benefit,” said Ursula von der Leyen, President of the EU Commission, in New Delhi on Tuesday. “This is only the beginning,” she added.

While the deal is significant for the development of the Indian economy and the stock market, investors’ focus remains on the India-US trade deal front, as the US, according to reports, remains India’s largest trade partner.

This agreement follows the finalization of a free trade agreement (FTA) between India and New Zealand, which was one of the fastest-negotiated agreements. Prior to this, India had signed trade agreements with Britain and Oman.

What is this “mother of all deals” all about?

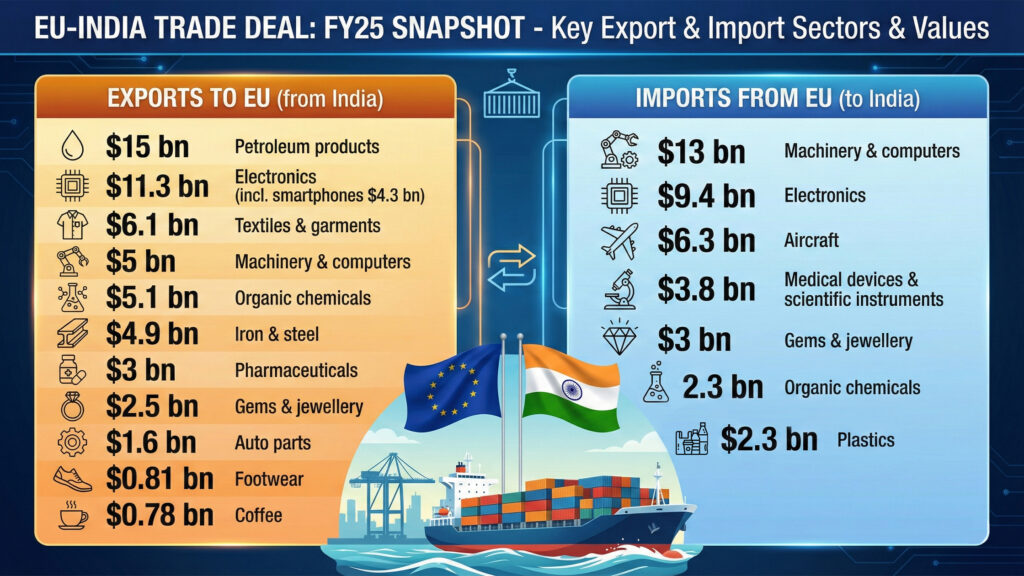

Let’s look at the India and EU’s import-export situation in the market. According to an official statement from this FTA deal memo, EU goods imports from India stood at €71 billion in 2024, while EU goods exports reached nearly €49 billion during the same year.

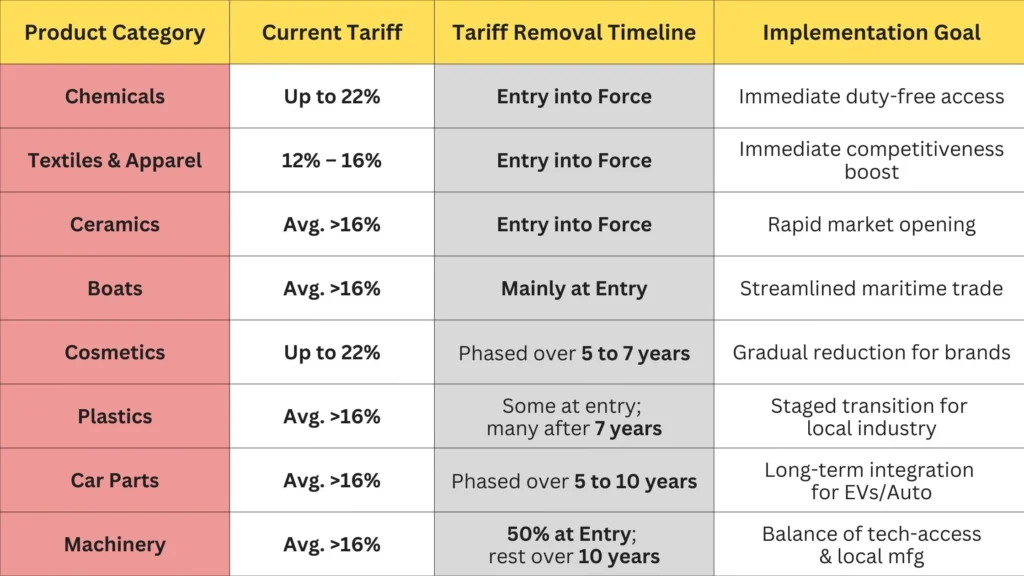

India will remove tariffs on 86% of tariff lines and 93% of value, while the EU will remove tariffs on more than 90% of tariff lines and 91% of value. Additionally, both parties will partially liberalize a sizable number of lines, increasing the total coverage of trade liberalization to 99.3% for the EU and 96.6% for India.

Strong benefits for key economic sectors on each side, such as:

- For the EU: agri-food, chemicals, pharmaceuticals, machinery, medical devices, avionics and automotive industries.

- For India: fisheries, chemicals, textiles, footwear and pharmaceuticals.

What benefits will the European Market receive?

India will remove high duties on industrial products (which, on average, are above 16%), such as:

Due to the high tariff barriers, EU exports of these goods have not yet been able to reach the Indian market, but these duty reductions and eliminations will make this possible.

Given India’s sensitivities and the extremely high level of protection in the agri-food sector, the Agreement strikes a balance by allowing market access in important export interests while maintaining sensitivities. Sugar and ethanol, rice and soft wheat, beef and poultry, milk powders, bananas, and honey will not be exempt; imports of table grapes and cucumbers will be restricted by well-calculated quotas.

What benefits will the Indian Market receive?

Overall, India is opening 102 subsectors to the EU, including those in the financial, maritime, and telecommunications sectors, while the EU is granting India access to 144 service subsectors.

Thanks to this EU-India FTA, India now has preferential access to European markets across 97% of tariff lines, covering 99.5% of trade value, in particular:

- 70.4% tariff lines covering 90.7% of India’s exports will have immediate duty elimination for important labour-intensive sectors such as textiles, leather and footwear, tea, coffee, spices, sports goods, toys, gems and jewellery and certain marine products, amongst others;

- 20.3% tariff lines covering 2.9% of India’s exports will have zero duty access over 3 and 5 years for certain marine products, processed food items, arms and ammunition, amongst others;

- 6.1% tariff lines covering 6% of India’s exports will have preferential access by way of tariff reduction for certain poultry products, preserved vegetables, bakery products amongst others or through TRQs for cars, steel, certain shrimps/ prawns products, amongst others.

Due to this FTA, important labor-intensive industries that are currently subject to import duties ranging from 4% to 26% in the EU—such as textiles, apparel, marine, leather, footwear, chemicals, plastics/rubber, sports goods, toys, gems, and jewelry—will now enter zero duty.

What does it mean for the Indian stock market?

Market participants noted that the India-EU agreement was largely discounted by the market. As a result, the announcement did not cause the market to sharply rise. The Nifty 50 closed at 25,175.40, up 127 points, or 0.51%, while the Sensex finished at 81,857.48, up 320 points, or 0.39 %.

According to Bloomberg reports, textile stocks saw a sharp reaction, with Kitex Garments, Welspun Living, and KPR Mill reporting significant gains.

Maruti Suzuki, a Japanese automaker, saw its stock close 1.5% lower, while Hyundai Motor India, a Korean company, saw its stock close 3.6% lower. Tata Motors and Mahindra, two Indian automakers, finished 1.3% and 4.2% lower, respectively.

Alcoholic beverage companies based in India also saw a decline in their stock. Sula Vineyards’ stock dropped 4.1%, while Heineken N. Vol. -owned United Breweries and United Spirits, owned by Diageo, saw a decline of more than 2%.

How does the US react to this EU-India “mother of all deals” ?

The White House has already criticized this agreement.

US Treasury Secretary Scott Bessant strongly criticized the European Union over the agreement with New Delhi. “We have put 25 % tariffs on India for buying Russian oil. Guess what happened last week? The Europeans signed a trade deal with India,” Bessent told ABC News on Sunday.

“They [the Europeans] are financing the war against themselves,” he added.

“First of all, strategically, it’s important to understand that because President Trump has prioritised domestic production and essentially started charging a fee for other countries to access our market, these countries are trying to find other outlets for their overproduction. And so the EU is turning to India to try to find a place. The EU is so trade-dependent. They need other outlets that they can’t keep sending all their stuff to the United States,” U.S. Trade Representative Jamieson Greer said in an interview with Fox Business.

“I think India comes out on top on this, frankly. They get more market access in Europe. It sounds like they have some additional immigration rights. I don’t know for sure, but President von der Leyen of the EU has talked about mobility for Indian workers into Europe. So I think on the net, India’s gonna have a heyday with this. They have low-cost labour,” he added further.

What is the future of the EU-India trade agreement?

India continues to pursue improvements in tariff-free steel export quotas; and the results of these negotiations are due by June 30 before EU regulations go into effect on July 1.

Meanwhile in the EU, just like any other trade agreement, this FTA will go through “legal scrubbing”, including translation into the 23 official languages of the EU. Following its submission to the Council for ratification, the EU and India will be able to formally sign the agreement.

However, the Council must decide on the conclusions and the European Parliament must support it for it to become operative. Even with significant political momentum, it is unlikely that the process will be completed in less than a year.